Disclaimer: None of what I write is a recommendation to buy or sell a stock. I am an internet stranger writing about random businesses with no successful track record in investing. This is a selfish endeavor to grow as an investor myself and to document my research as I do not have a good memory. Please do your own research before buying a stock.

If you like reading pdfs, here is a pdf version of this writeup.

Thesis - The Shorter Version

A consistently profitable business, which got into short-term trouble, trades at 4x depressed FY23 earnings, even after the management has multiple measures in place, including a clear capital allocation plan, to go back to past profitability. Interestingly, a former chairman, who owns 5.5% of shares outstanding and helped turn the company around from a similar situation in 2010, is back at the company.

Warning: This company is a highly illiquid nano-cap, so any trades should be placed as limit orders.

What does The Mission Group do?

The Mission Group(Ticker: TMG - traded on the AIM in the UK) is a collection of several independent advertising agencies that were acquired over a period of time. According to Wikipedia, an ad agency is defined as “a business dedicated to creating, planning, and handling advertising and sometimes other forms of promotion and marketing for its clients”. In plain terms, they come up with marketing strategies and advertising campaigns for their clients.

Some of their clients include reputable names like Google, Porsche, Under Armour, Citibank, Barclays etc. These are effectively creative jobs where labor costs form the majority of the operating expenses. Relationships with clients matter a lot and companies typically do not switch ad agencies for the most part - thus, switching costs can be thought of as a competitive advantage for ad agencies in general. This article from Geoff Gannon details the competitive dynamics of ad agencies, but this is not too important to this thesis, at least at the current price.

P.S. All of Geoff Gannon's writings are legendary!

Financials

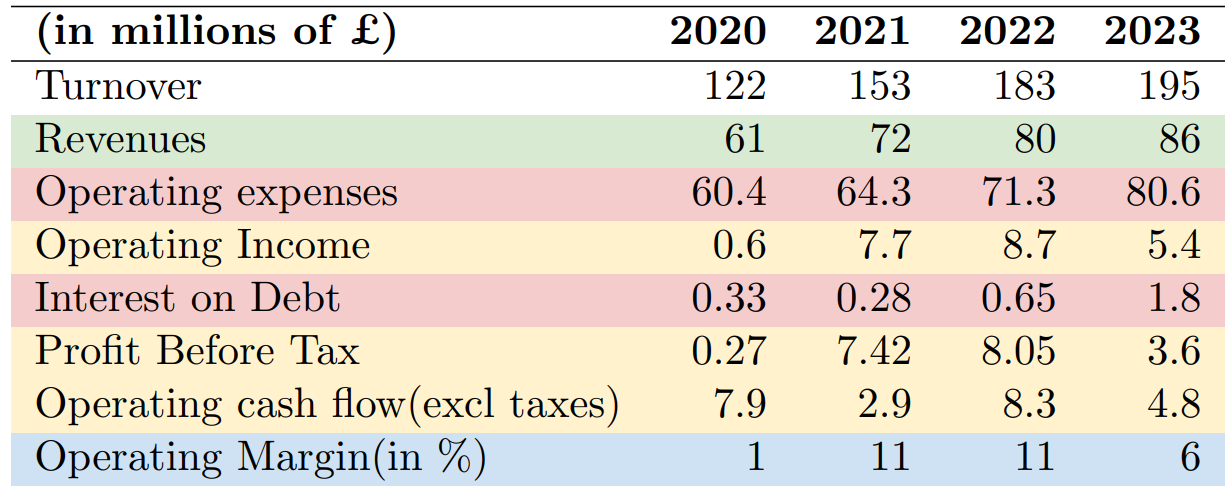

The business has been profitable, from an operating profit perspective, every year since 2009(I could only verify numbers from 2009 onwards), with very good conversion to operating cash flows. Here are their financials over the years:

In the numbers above, the “turnover” numbers represent their accounting revenues. A big part of their “turnover” involves pass-through costs, which appear as accounting revenues from clients. The “revenues” mentioned in my presented financials above, are obtained after deducting these pass-through costs from their accounting revenues. Let’s call my revenues “headline revenues”. For the purposes of my analysis, I have ignored the turnover numbers and substituted those with headline revenues mentioned in my financials above.

In the numbers above, one can see that their operating profits and profits before taxes have been very good and consistent over the last 15 years. They came close to breakeven during covid but recovered quickly in FY21 and FY22, with £8.7M of operating profits and £8M of profits before tax in FY22. Overall, the business has been consistently throwing off cash from operations as well. What did they do with all the cash?

Their Story So Far

As I mentioned in the beginning of the article, they were saddled with debt in 2009. So, from 2010 - 2013, they hardly made any acquisitions as they focused on their existing operations. However, they have been very focused on acquisitions from 2014 onwards. Till about 2019, it seems to have worked out okay, with operating profits nearly doubling from pre-2014 levels. Personally, I did not like the capital being allocated majorly to new acquisitions in this period, even though they seemed to have got good enough results from it.

Their results in this period were also helped significantly by the fact that the year 2013 marked the nadir of their operating margins(even though the ad agency business is a good business, it is cyclical). This growth in operating profits from 2014-2019 was disrupted in 2020 by Covid. The results of the acquisitions in the cycle from 2020-23, look more bad than in the previous 2014-19 cycle, probably because their operating margins also peaked in 2019 and also as a result of the difficulties faced in FY23, which we will get to in a bit.

One important thing to note is that their acquisitions deals are set up in such a way that the initial cash outflow is pretty minimal, with the majority of the payouts to be made in future years, based on business performance. This minimizes risk to an extent. However, it can also come back to bite them, as they may have to put up cash during a period where some of their other ad agencies are going through a difficult period. What has been going on with the company of late?

Current Difficulties

Now, we come to an important part of this thesis - their current difficulties. They faced heightened difficulties in FY23 as they breached some financial covenants of their revolving credit with Natwest Bank, with the downturn in their technology ad agency segment. This part of their business had prepared itself for growth, considering the growth in the prior years. However, as the tech industry suffered from a downturn in 2022/23, some of their clients elected to defer their marketing spend for the year, resulting in reduced revenues in the segment, along with increased operating expenses(it turned out that they were overstaffed for the eventual revenue numbers).

This tech business difficulty was probably only responsible for the tipping point to occur. I would say that their situation was their own doing to a larger extent. Their debt levels were already somewhat high, partly due to funding their past acquisition liabilities and also because of continuing to pay increased dividends, even though the business was still recovering post covid. The downturn in their tech business in FY23, pushed operating income to even lower levels, with operating margins coming down to 7%, their lowest number, at least since 2009 - their lowest margins from 2009-22 was 11%(except the covid low in 2020). This decline, combined with increase in debt, caused some of their debt covenants to be breached, leading to a steep decline in share price.

The trading update about their difficulties was released on Oct 23, 2023. On this day alone, the share price dropped from 34 pence per share to 14 pence, a drop of 60%! A week later, on Oct 30, 2023, the share price reached a low of 10.5 pence per share, a shocking drop of 70% within a single week! This is what lower liquidity in microcaps along with existing shareholders anxiously running for the exit, can do. As Mohnish Pabrai would say, you were caught in a burning theater, with the added requirement that you had to sell your seat to someone else to exit. All seats have to be taken at all times within the theater - that is one of the rules of the game. With the lower liquidity, the situation was more akin to a burning theater, in the middle of a deserted island. There was no one to sell your seat to! Just to give a perspective, at their lowest, $TMG was trading at a market cap of £9M, about the same as their entire profits before taxes for the year 2019! The share price has recovered quite a bit from there, with a current share price of 19 pence(£17M market cap).

As also often happens when a public company is going through a difficult period, corporate raiders were surrounding it. Brave Bison, another ad agency business, a comparatively smaller company in terms of revenues, tried buying them out. However, The Mission Group board rejected their offer, reasoning that it significantly undervalued the company.

What is the opportunity?

After breaching their debt covenants, they refinanced their revolving credit facility with their lender, Natwest Bank. Prior to this refinancing, they were paying an interest rate of 1.5% - 2.25% above the pound sterling benchmark rate(SONIA)(exact rate depends upon their leverage ratio). Their interest rates went up to 2.25% - 4.9% above the benchmark. David Morgan, the former chairman under which the company turned around operations in 2008/09 is back as the chair of the company from the end of 2023. He owns 5.5% of shares outstanding. He founded Bray Leino, the largest ad agency part of The Mission Group, in 1974 and was its CEO until 2008. He was appointed chairman of The Mission Group in 2010 and led the turnaround from a similar highly indebted situation. This VIC writeup gives some more details about this. The company’s profit before tax almost trebled from a bottom of £3.2M in 2010 to a peak of £10.4M in 2019. Their stock price, in the same period, increased from a low of 11 pence to a high of 84 pence.

Currently, their net debt from their revolving credit facility is £20M. If you add their outstanding acquisition liabilities(from past acquisitions) of £5M, their adjusted net debt is £25M. The company announced a “Value Restoration Plan”, which was also a part of their revolving credit refinancing agreement, to cut down on £5M of operational expenses in FY24. They have also announced that they will not allocate any capital towards acquisitions, perform minimal capex and instead use the cash flow from operations to pay down debt for FY24 and FY25. They sold a non-core subsidiary in 2023 for £1M, which is not much. However, they have indicated that they may sell another non-core subsidiary and are exploring additional options to bring down debt. I suspect they might sell a few of their 19 ad agencies to realize value and bring down debt faster. However, this is just a conjecture at this point.

Valuation

Their operating income, after adjusting for discontinued operations, miscellaneous expenses and lease payments, was £6M in FY23. After interest payments of £1.8M, adjusted profits before tax was £4.1M. At a market cap of £17M, the company trades at a PE of 4x. This multiple is applied on, what is, in my view, already depressed earnings. As I had mentioned earlier, their operating margin of 7% in FY23 is already their lowest number, at least since 2009. Their previous lowest operating margins from 2009-22 was 11%(with the exception of the covid low of 1% in FY20).

One does not have to make great assumptions about their revenues growing, operating income growing or margins expanding, although all of these would be nice to have. Upside can simply come from the £5M of cost savings planned for FY24. Management mentions that the majority of the cost savings is planned for the second half of FY24. Their business is also seasonal in nature, with most of their profits typically coming in the second half of a year, with minimal or break even profitability in the first half. I will be watching the second half results of FY24 more closely as that can be a catalyst for the share price. Even if one assumes that there is £2M of operating income improvement from the £5M cost savings program, PE at current market cap will be 3x(£8M of OI, £6M of Profits before taxes, on a £17M market cap).

Let’s say, a shareholder who purchases shares today, decides to stay for a couple of years, the company may pay down £12M of net debt from the £25M number. What is a business with £8M of operating income with £13M of net debt worth? I am not so sure, but I know that it will be worth much more than the current £17M market cap - At £17M, it will be trading at 3.7x Enterprise Value to Operating Income and 2.4x multiple of profits before tax. If you assume the business gets back to a level of Operating income of £10M prior to covid, these multiples will be even lower. Even if any of this doesn’t happen, the company still generated £5M of cash in FY23 and value can accrue to equity holders, just with the deleveraging planned for FY24 and FY25.

Let’s look at the value from other angles. How much did Brave Bison offer for the company during its takeover attempt from Nov 23 to May 2024? The final price offered was 33 pence a share, valuing the company at £30M, which of course the board rejected, saying it undervalued the company. Still, that price was almost 2x the current share price.

The Mission Group’s book value consists almost entirely of intangibles. If you think about it, there is not a lot of capital required to be put into this business. All you probably need is to lease an office space and hire some staff. If you land projects, revenues flow into the business gradually over the lifetime of a project and one can pay employees from this revenue. Business trades at a Price to Book of 0.2(even after they wrote off about £15M of intangibles in the last 2 years) - I do not want to use this as an indication of absolute value as it is not a tangible value. However, I do think that they give an idea about the level of depression in the current market cap. There can be a 2x upside, even if they trade at 0.4x Price to Book. I believe, if the many ad agencies inside them are sold, they will be far more valuable than what the market currently gives credit for. In other words, I believe that business relationships which allow ad agencies to have recurring earnings from a somewhat constant client base, should be worth a lot more than the current market cap.

Pre-mortem

This is an attempt to hypothesize on what could potentially go wrong with this thesis.

Management continues to make acquisitions

I consider this unlikely at least for the next 2 years, especially with what they have just been through - difficult business environment, breach of debt covenants, refinancing their debt by promising to bring down debt(“Value Restoration Plan”), surviving a takeover attempt.

David Morgan, a 5.5% shareholder, coming back as chairman, with his past track record of turning around the company successfully from a similar situation, also gives me additional confidence about this potential risk

Acquisition liabilities end up being larger than the £5M management has estimated currently

Over the past 15 years, their acquisition estimates have been more or less accurate, but still this is a risk factor

Final Thoughts

Overall, at the current valuation, I think there are a lot of ways for shareholders to make money and not a lot of ways to lose money, I like the odds being offered. In the first half of 2024, their capex was close to zero and did not announce any acquisitions. I would be keeping a close watch on whether the management adheres to what they have said and on how the company performs over the next 1-2 years. If the operating income increases and the debt comes down with no acquisitions, I’ll see how the market values the company then.

Disclosure: Long TMG

Great write up! Seems very interesting

Why would you adjust for lease payments in operating income?