Disclaimer: None of what I write is a recommendation to buy or sell a stock. I am an internet stranger writing about random businesses with no successful track record in investing. This is a selfish endeavor to grow as an investor myself and to document my research as I do not have a good memory. Please do your own research before buying a stock.

If you like reading pdfs, here is a pdf version of this writeup.

This post is about a couple of recent positions. The first one is a special situation that gives investors free optionality with a solid downside protection. The second one is an extremely cheap, cash rich and profitable microcap close to cyclical lows. Both of these are trading at market caps close to cash on their balance sheets.

Warning: The companies mentioned are highly illiquid nano-caps, so any trades should be placed as limit orders.

XL Media(AIM:XLM)

XL Media is a sports betting company, with operations in North America, Europe and Canada. The following is XL Media Group’s long term share price chart - it reached an all time high of £2 per share in 2017 and a low of 7 pence per share in 2024!

Looking at the long term share price chart above, it may look like one would need a big stomach to be long this stock. Let us look at their financials in the last few years(from tradingview.com):

After looking at their declining revenues above, I was just about to give this company a pass until I started reading their latest filing, when it suddenly seemed like a pretty simple and attractive situation. This special situation does not have a big upside in terms of absolute returns, however, one I believe is attractive on an IRR basis. @ToffCap and @alvarogomezolea on twitter, had shared about XLM in the past, which helped me shape my thinking about this opportunity. I encourage readers to go through their tweets about this company.

Story so far & Opportunity

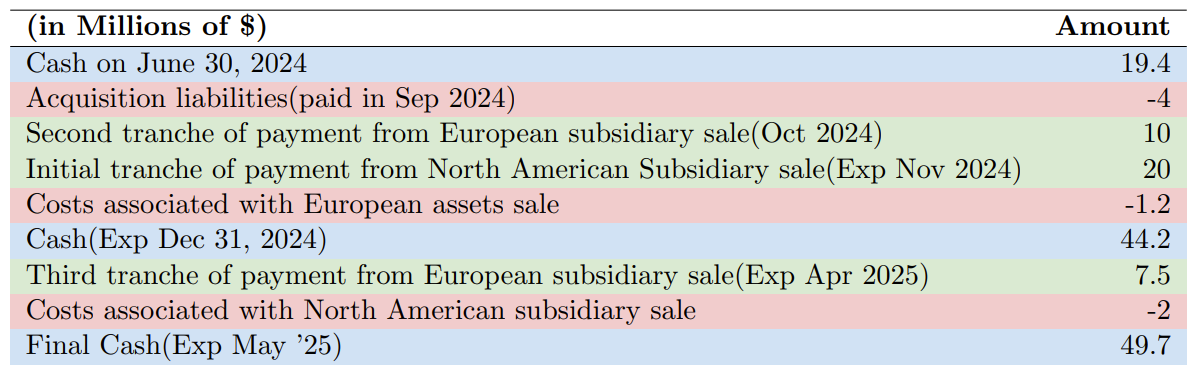

As I mentioned earlier, XL Media is a sports betting company, with operations in North America, Europe and Canada. The company sold its European and Canadian operations in March this year for $37.5M, plus a potential $5M in earnouts in April 2025(depending on the business’ performance). Out of the $37.5M, they already received $20M of cash in April 2024. They received another $10M in Oct 2024 - the second tranche of payment from this sale. The remaining $7.5M plus any potential earnouts will be received in April 2025. Cash reported by the company at the end of the first half of 2024(June 2024), was $19M. In September, they paid $4M relating to a past acquisition liability. They do not have any further payments left related to past acquisitions.

The company recently announced the sale of its remaining North American operations to Sportradar, on 21st October 2024, for a maximum consideration of $30M, with $20M to be payable on completion(following shareholder approval) and up to an additional $10M payable in April 2025, based on business performance.

With the announced sale of the North American subsidiary and the previously completed sale of the Company’s Europe and Canada assets, XLMedia has almost no operations left and will become a Cash Shell, focused solely on the orderly distribution to shareholders of the proceeds. The company also mentions that this final sale would result in the divestment of “substantially all of the Company’s existing business, assets and trade liabilities”. The company also mentions this:

“It is expected that trading in the Ordinary Shares will be suspended on or around 12 May 2025. The Company will then have a further six months following the date of suspension before the Company’s admission to trading on AIM is canceled. The Directors’ current expectation is that the Company will have taken steps to effect cancellation of its admission to trading on AIM by this time.”

I believe all of the payouts to shareholders should be completed by May 2025.

Probabilities

Firstly, what is the likelihood of the North American subsidiary sale going through? The buyer, Sportradar AG, has already received irrevocable undertakings from Premier Investissement SAS and the Directors of the company representing approximately 31.18% of the Ordinary Share capital to instruct a vote in favor of this transaction. If my understanding of AIM rules is correct, a simple majority of votes cast should be enough to obtain approval. They only require about a quarter of the remaining votes for the deal to go through. Looking at the past financials of the company, revenues seem to be on the decline, combined with a history of bad acquisitions at high prices leading to large asset write downs. Given the value destruction, I believe this transaction should be approved by shareholders, as there seems to be no better alternatives(Update: This sale was approved by shareholders on November 7th, 2024).

Now, the acquiring company, Sportradar, is also a publicly traded company. What are the odds that Sportradar’s shareholders will approve this transaction? 80% of the votes of Sportradar is controlled by its founder-CEO and hence, it is almost a certainty that this transaction will be approved.

Does Sportradar have the ability to fund this acquisition? Sportradar’s maximum price of $30M, for this acquisition is just 10% of the $290M of net cash on hand, so it can very easily fund this acquisition.

Are there any antitrust concerns with this transaction? It seems highly unlikely, given that Sportradar is a much larger company(market cap of $3.7B) in the sports betting industry. With this transaction being worth just $30M, I think it is highly unlikely that this would reduce competition in any meaningful way.

Numbers

In these types of special situations, cash in and cash out is all that matters for our IRR.

NOTE: For the costs associated with European assets sale, management mentioned $2.5 of costs over a 6 month period beginning April 1st. So by June 30th 2024, I consider that half of those costs have already been expended.

We get to a net cash of approximately $50M, however, there are some liabilities to be accounted for. The company mentions this:

“The Board intends to make an initial distribution to shareholders from available capital in Q4 2024, the amount of which will be determined after providing for the ongoing costs and working capital requirements of the residual runoff business and outstanding liabilities(including historical tax liabilities).”

The company in their 2023 Annual Report mentions a tax liability of $5.7M. There should not be any tax liabilities arising from the sale of these subsidiaries as they were bought at higher valuations in the past. There is also a cash burn to account for - the period from now until May 2025 - when the company will have almost no revenues but still have expenses to deal with. After the announcement of the intended sale of the North American subsidiary, the company said the following:

“Following Completion, XL Media PLC (and its subsidiaries) will have sold its primary trading activities accounting for some 95% of its remaining business revenues.”

The company also said this about its residual obligations:

“The Group will therefore retain staff to support its residual obligations including: transitional service arrangements, group reporting, filing and listing requirements, commencing the orderly winding-up or strike off process for the Group’s subsidiaries, collecting cash from purchasers of the Group’s assets, and supporting the board in making subsequent distributions. Remaining staff numbers will reduce to levels commensurate with the run off of the residual business.”

The company currently trades at a market cap of $40M(£31M). So, the market is predicting that there may be $10M of cash burn plus liabilities to be paid. If one takes tax liabilities to be $5.7M from their balance sheet, the market estimates $4.3M of cash burn. Top management including directors have an annual salary of $1.1M, so this would cost about $600K until May 2025. I am unsure how much it would cost to support the company’s residual obligations stated above and how much their winding down costs would be, but it should not be material. To be conservative, let’s assume that $4.3M is correct. If it is lower than this, it would add to the returns. So if the company is worth $40M and the market cap reflects that, where is the upside?

The upside comes from their potential earnouts. As the management has stated, we will get the vast majority of the $44M of cash at year end(from calculation above), after accounting for remaining expenses, back by December of this year. Then, there could be a positive surprise from earnouts in April 2025, with a maximum amount of $15M($5M from European assets + $10M from North American Assets).

Dilution is another factor to take into consideration as well. There are 8.7M unvested shares outstanding from performance stock awards to management, which represents 3.3% of current outstanding common shares of 259M. Converting the minimum calculated value of $40M to a per share basis, after accounting for dilution, comes out to 11.6 pence a share, which is pretty close to the current share price of 11.8 pence.

Right now, if you assume the total expenses plus liabilities to be $10M, the market is not assigning any value to the potential earnouts, at a market cap of $40M. So, this is essentially like buying a free option. I am not sure what the exact conditions of these earnouts are, and how likely it is that shareholders will receive any or part of these payments. However, I do know that the downside is well protected by the guaranteed cash, expected to come in. This is a classic “heads you win, tails you don’t lose much” situation. There is uncertainty related to how much the earnouts can be or how much the cash burn and liabilities can be, but I feel the downside is very well protected. Instead of having my cash earning 4% on US Treasury Bills, I believe it would be put to better use sitting in XLM shares. This special situation is expected to play out over the next 6 months. I tried projecting out IRRs from this situation based on different scenarios.

NOTE: Final cash expected from my earlier calculations was approximately $50M. I have assumed $10M of liabilities and cash burn in all scenarios. So a total cash of $40M is expected to be paid out, excluding earnouts, in all scenarios. The only assumption that varies in the different scenarios above is the amount of earnouts - I believe this amount has maximum uncertainty. Out of the $44M of cash expected to be available by Dec ‘24(from my earlier cash calculation), I have assumed $30M to be paid out by 2024 year end.

Premortem

What might go wrong with this thesis?

Tax liabilities and cash burn turn out to be higher than my assumed $10M.

Maybe there is a surprise expense which I have not accounted for.

There are delays in the distribution of the cash to shareholders.

Final Thoughts

Earlier, I used to think that there needs to be a minimum upside of a 2x or a 3x for me to consider investing in a stock. Of late, I have been getting the realization that it all depends on the level of downside protection as well. If your downside is well protected, the world’s randomness can only help your portfolio performance. This position is an attempt to do just that. I do not know what is the likelihood of the different scenarios playing out from my IRR projections above. All I do know is that the likelihood that XLM is worth less than $40M is very minimal. Meanwhile, I will grab some popcorn and enjoy the action from the sidelines for the next 6 months.

Surge Components(OTC:SPRS)

Business

Surge Components, founded in 1981 and headquartered in New York, is a supplier of electronic components - capacitors and discrete semiconductors like transistors, diodes etc. These components are different from integrated circuits(with multiple components on a single chip) such as microprocessors and are packaged alone. These go into all kinds of products like automobiles, cell phones, telecoms, computers and so on. They are very capital light since they outsource manufacturing to manufacturers in Asia. Capacitors form the bulk of the revenues the company makes, at 30%. Most of these capacitors are manufactured by a Taiwanese company, Lelon Electronics(three quarters of the 30% revenues from capacitors is from Lelon).

Average price of a component sold by Surge is about 5 cents - from a commercial diode selling for less than a cent to more than $2 for high power capacitors. In the last twelve months, Surge sold about 400M components. Charlie Munger, in the 2018 Berkshire Hathaway Annual meeting, while discussing the economics of TTI Electronics, a bigger distributor of electronic components owned by Berkshire, compares the difficulty of the business of distributing millions of small electronic components to gathering and rendering dead horses. He said that the business of distributing such small value items is complicated and hence limits competition. These are some excerpts from Warren and Charlie from the meeting:

CHARLIE MUNGER: Yeah, it’s a wonderful business because it’s so difficult to do that competitors don’t want to try it. When I lived in Omaha there was a man who lived in great prosperity and almost no work. And his business was gathering up and rendering dead horses. And he never had any competitors. He used to come up to the Omaha Club and start drinking about 11 in the morning. It was not a difficult business. But nobody ever crowded him with new competition. And very few people want to distribute zillions of electronic parts that are worth a nickel each. It’s very complicated. And of course that business is terribly good at it. And it keeps getting more and more of the same. So you’re right. It’s a huge growth business which is sort of the electronic equivalent of gathering up and rendering dead horses.

WARREN BUFFETT: Imagine keeping track of close to a million different items, you know, with very small values attached to them and getting them out to your customer fast because they want them fast, all over the world. You know, and those things are not easy to manage. I mean, yeah.

CHARLIE MUNGER: And staying in stock on so many items. It’s very complicated.

The legendary Dan Schum had written up this company on his NoNameStocks blog.

Financials

NOTE: I have considered numbers until the quarter that ended on 5/31/2024 for my analysis.

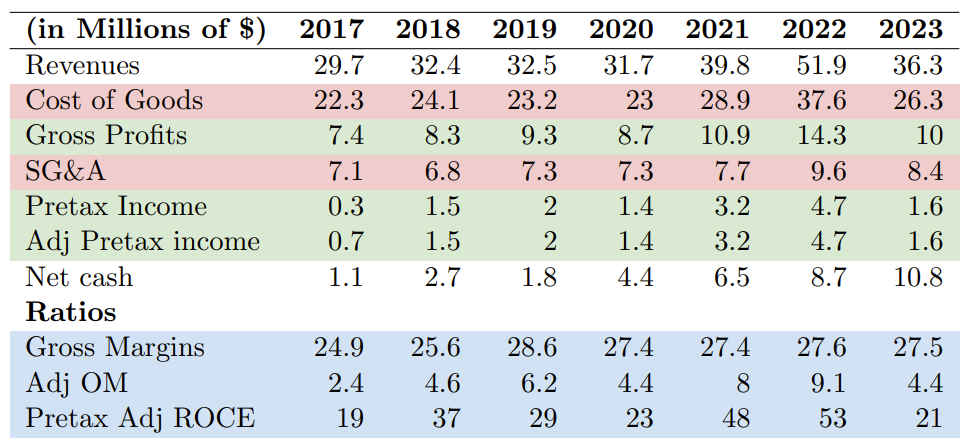

As one can see above, once you net out the cash, the business comes for free at the above market cap. The company has been profitable every single year, at least for the past 14 years(since 2010), with pretty stable gross margins(25-30%). They reported a small loss in 2016 due to a proxy fight. After adjusting for non-recurring expenses, they were profitable in 2016 as well. Operating margins have been cyclical, ranging from 2.7% to 9.1%.

The company had a sudden SURGE(pun intended) in revenues in FY21 and FY22 to $40M and $52M respectively from $32M in FY20. Due to shortages in electronic components markets, customers had over ordered in these years, leading to excess inventory on their balance sheets currently. Hence, customers have reduced their orders, which resulted in revenues for Surge coming back down in FY23 to $36M(TTM revenues of $30M). The company still made $1.6M of pre tax earnings in FY23 and $0.9M of TTM pre tax earnings. Revenues have fallen off a cliff, with potential upside coming from the tide turning, when customers start to re-order more as they deplete their inventories. The company, in their latest 10-Q, says they expect to see customers getting back to normal ordering levels by the second half of 2025. There may also be higher potential demand created in the future, from the growth of artificial intelligence, data centers and electric vehicles, although this is not important for this thesis.

Proxy Fight

When one looks at the management’s capital allocation history, I was surprised to find that they had repurchased about 50% of shares outstanding in a single year in 2017, when they had a lot of excess cash on their balance sheet, somewhat similar to today. They had bought back 5M shares for about $7.1M at about $1.4 a share.

In 2016, the founders of the company, owned about 20% of the company, with insiders owning about a quarter of the company. So, with the large free float available, a couple of investors took about a 23% stake in the company and initiated a proxy contest. They had demanded a bunch of things, like moving the incorporation of the company from Nevada to Delaware, changing the auditor from a smaller firm to a more renowned one, let shareholders have more say in the election of board members, etc. In the end, there was a settlement made, with a tender offer for 50% of the shares outstanding, at a 43% premium, to the existing share price then. After half of the shares outstanding were repurchased in a tender offer. This resulted in the ownership of the founders increasing to 40%, with insiders owning almost half of the company. There has been quite a bit of dilution already from there, with insider ownership going up from 47.5% in 2017 to 53% today.

After this episode above, they have again let cash accumulate on their balance sheet, with no dividends or buybacks. There is no incentive to do so now. Also, there cannot be another proxy fight today as the majority of shares are owned by insiders. The company had made a bunch of agreements as part of the settlement, for example moving its incorporation to Delaware, which they did in 2019 but moved back the incorporation to Nevada in 2021!

Earlier NASDAQ Listing

The company was originally traded in the NASDAQ in the 90’s and early 2000’s. Surge was delisted from the NASDAQ in 2001 for “potentially questionable payments”(read as kickbacks/bribes). In 2001, Surge self reported that they had made payments worth $2.8M to the “wife of an employee of a supplier” in Asia, in return for help obtaining components. The legal advice they had got before making these payments was that these payments would “not be illegal” if there was a Form 1099 filed with the IRS for these payments. However, in an unrelated case, they had seen such payments being described as “kickbacks” and therefore decided to self-report their questionable payments themselves to their auditors. This was first disclosed in their 10-Q for the quarter ending February 2001. NASDAQ decided to kick them off the exchange as Surge’s top management did not cooperate with their hearings. In 2001/02, they were contacted by the SEC to furnish more details, which they did. Surge hasn’t been contacted by the SEC after Surge’s response back in March 2002. Surge also indicated that they have taken steps to ensure such payments do not occur in the future.

This whole situation was quite sketchy and it is quite probable that the founders knew of these payments beforehand. The US passed the Foreign Corrupt Practices Act(FCPA) in 1977, which prohibits US companies from bribing foreign officials to benefit their business interests. However, the law was not enforced actively until the mid 2000’s or so. Bribes were seen as a necessary evil to do business in Asian countries until then. For example, in Europe, companies were even allowed to deduct kickbacks they had paid against tax. However, the US stepped up the enforcement of the FCPA from the mid 2000’s. This article from the Economist mentions that until 2007, the largest fine under the FCPA was $50M. By the mid 2010’s, this number had gone up 10-15x. It seems like, with the fear currently that you would be forced to face enormous consequences for such kickbacks now, corporate executives are strongly incentivized not to indulge in such activities. Though the ethics of the current management should be rightly called into question, I think there may not be a repeat of this in the future.

Valuation

Surge’s average annual pre-tax earnings since 2010 has been about $1.6M. If one values this at a 10x multiple, and considering net cash of $12.5M on their balance sheet, this can easily be a double from the current market cap(I bought into this when the market cap was $12.5M, now it has gone up a bit to 13.4M). With a market cap equal to net cash, the downside is very well protected. However, the upside is also somewhat limited, ironically, by the same fact that a lot of the current value comes from net cash(current PE multiple is 13-14x based on TTM earnings, ignoring net cash).

Pre-mortem

What might go wrong with this thesis?

Management does something crazy with cash on the balance sheet by doing bad acquisitions.

Even if all cash disappears, I think the company still trades slightly below or close to intrinsic value.

Company does not adhere to the rules of law in places where it does business, leading to unexpected fines and liabilities.

Revenues do not come back to normal in the next 2 years or so.

Final Thoughts

Overall, with the incorporation of the company in Nevada, management treading close to the rules of law, excessive shareholder dilution, excessive management salaries(top management and director salaries equal $1.1M in FY23 on pretax income of $1.6M), combined with no payments of dividends - there is not a lot to like about Surge’s corporate governance and the way they treat minority shareholders. As a result of all of this, even though Surge is dirt cheap, I could not go over a 2% position in this company.

I believe capital allocation policies are not going to change, with cash continuing to build up. This business could be worth much more in the hands of a better management team, but unfortunately we got to live with the present one.

Disclosure: Long XLM, Long SPRS

Great writeups! I’m enamored with Surge’s net cash, valuation, and simple business.

Unfortunately the fact that management rebuffed activists in 2017 and gained 40% ownership makes this a pass for me.

thanks for presentation of XLM

An obvious question about the liquidation :

considering that retained earnings are negative in the book, then there shouldn't be any withholding tax on the liquidation.

Still, it seems a bit disapointing XLM chose not to try to monetise this huge NOL (almost 78M)